The low-altitude airspace economy is emerging as a strategic sector in China, fueled by advancements in digital and intelligent technologies, the adoption of electric vertical take-off and landing (eVTOL) vehicles, and the proliferation of drones. This article explores the insurance opportunities and challenges in this evolving market, projecting its future growth to reach CNY 8-10 billion by 2035. Key issues such as risk assessment, regulatory impacts, and technological advancements are examined to provide a comprehensive understanding of the landscape for stakeholders in the low-altitude airspace ecosystem.

China plans to expand the scale of its low-altitude economy to 1.5 trillion yuan (US$207 billion) by the end of 2025

Xinhua

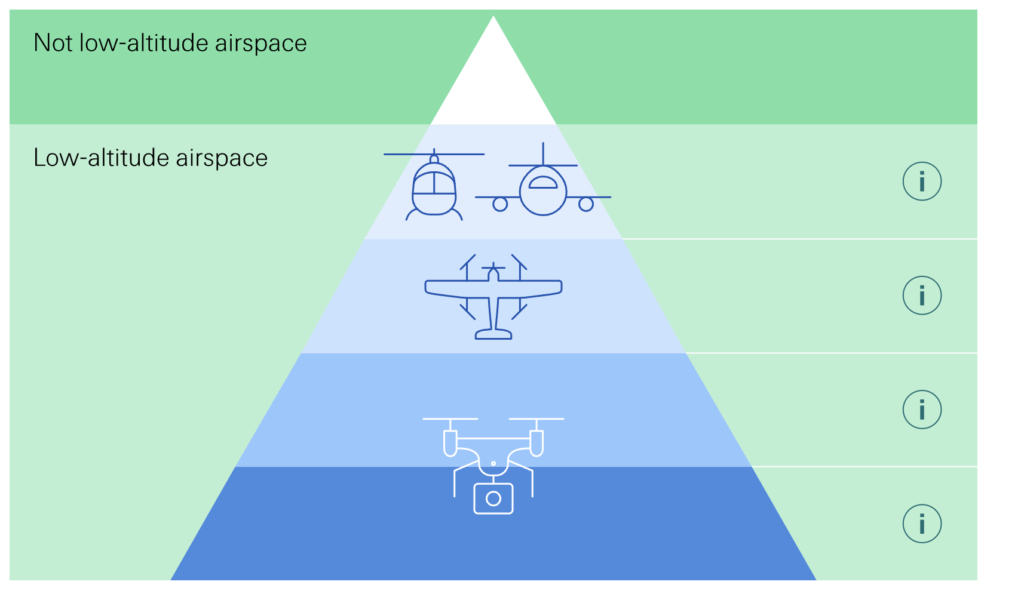

The low-altitude airspace economy is increasingly viewed as a strategic emerging industry in China, with significant implications for urban air mobility (UAM), digital technology integration, and economic development. Advances in eVTOL technology and drones are leading to the creation of new transportation methods that operate within the low-altitude airspace, covering altitudes up to 3000 meters above ground. This sector encompasses a broad range of applications, from agricultural drones and logistical services to emergency rescue operations and aerial surveying. The rapid growth of this sector necessitates a robust insurance framework to address emerging risks and provide financial stability to businesses operating within this space.

What is the Low-Altitude Airspace Economy?

The low-altitude airspace economy refers to the economic activities associated with UAM transportation, the manufacture and operation of UAM aircraft, related infrastructure, and their integration into conventional industries. By 2023, China’s low-altitude airspace economy had already exceeded CNY 500 billion, with projections indicating a substantial growth to CNY 3.5 trillion by 2035 (CAAC, 2023). The sector’s rapid evolution is driven by technological advancements such as the use of lithium batteries, sophisticated communication and sensing technologies, and artificial intelligence. The global market for drones alone is expected to reach USD 55.8 billion by 2030, growing at a compound annual growth rate of 7.8% (Swiss Re Institute, 2024).

As shown in the figure above Low altitude aircraft include drones, which are typically unmanned aircraft, and the rapidly evolving segment of electric vertical take-off and landing (eVTOL) vehicles, which can carry passengers, as well as commonly used general aviation planes and helicopters that operate within the limited airspace.

Risk Assessment in the Low-Altitude Airspace Economy

Risk assessment in the low-altitude airspace economy is complex due to the diverse nature of aircraft types and their applications. The risks associated with drones and eVTOLs are more influenced by their specific usage scenarios, flight conditions, and operating environments. Factors such as aircraft manufacturing capabilities, supply chain security, and the stability of services all contribute to the risk landscape (Swiss Re Institute, 2024). The main risks include the potential for equipment malfunction, cybersecurity breaches, and liability issues related to privacy and data security (Dai & Kuang, 2024).

Emerging legal challenges also pose significant risks, particularly related to algorithm standards for drones and eVTOLs. These technologies are not yet adequately covered by existing insurance policies for general aviation aircraft, leading to ambiguity in product liability and third-party claims. The absence of clear regulatory frameworks and safety standards can result in disputes over liability in case of accidents, as evidenced by recent court cases in China.

Insurance Opportunities in the Low-Altitude Airspace Economy

The Chinese property and casualty (P&C) insurance market is increasingly targeting the low-altitude airspace economy. As of July 2024, there were 45 insurance products specifically tailored to cover risks associated with drones and eVTOLs (Insurance Association of China, 2024). These policies cover a range of risks from drone property damage to third-party liabilities and personal accidental injuries. Major Chinese insurers are developing package solutions that include professional liability, cyber security, and conventional property and liability risks, aiming to provide comprehensive coverage for all aspects of low-altitude airspace activities.

Technological advancements and regulatory improvements are expected to drive economic value in the low-altitude airspace economy. Insurers are likely to face increasing risk exposures as the use of drones and eVTOLs becomes more widespread. This necessitates the development of new insurance products to address these complex risks. For example, agricultural drone insurance is already part of policy-based agricultural insurance in some regions, indicating a tailored approach to risk mitigation.

Future Outlook and Challenges

The low-altitude airspace economy presents significant opportunities for insurers, but also several challenges. The projected growth to CNY 8-10 billion by 2035 depends on the ability of insurers to accurately price and manage emerging risks. Challenges include the rapid pace of technological advancements, evolving application scenarios, and consumer behavior changes. Insurers must innovate and adapt by developing specialized products that cater to the unique risks of drones and eVTOLs.

The projected growth to CNY 8-10 billion by 2035 depends on the ability of insurers to accurately price and manage emerging risks.

Xin Dai & & Kira Kuang

The increasing complexity of risk assessment and the absence of clear standards in safety requirements for UAM aircraft pose potential barriers to growth. Insurers must address issues such as the definition of coverage scope, insured obligations, and exclusions through extended policy clauses to avoid disputes over liability (Dai & Kuang, 2024). Furthermore, the insurance industry needs to foster better collaboration with manufacturers and operators to enhance data collection and risk modeling, which are critical for assessing new technological risks.

Conclusion

The low-altitude airspace economy in China represents a dynamic and rapidly evolving sector with immense growth potential. Insurers play a crucial role in this ecosystem by offering specialized insurance products to manage the complex risks associated with drones and eVTOLs. The path forward involves overcoming challenges related to regulatory clarity, technological advancements, and market segmentation. By 2035, the low-altitude insurance market is expected to reach CNY 8-10 billion, driven by increasing use of drones and eVTOLs in urban air mobility and other applications. Insurers that are proactive in developing tailored products and enhancing risk assessment methodologies will be well-positioned to capitalize on the opportunities in this emerging market.